What has been occurring in Sri Lanka?

Fights began in the capital, Colombo, in April and spread the nation over.

Individuals have been battling with day to day power cuts and deficiencies of rudiments like fuel, food and meds.

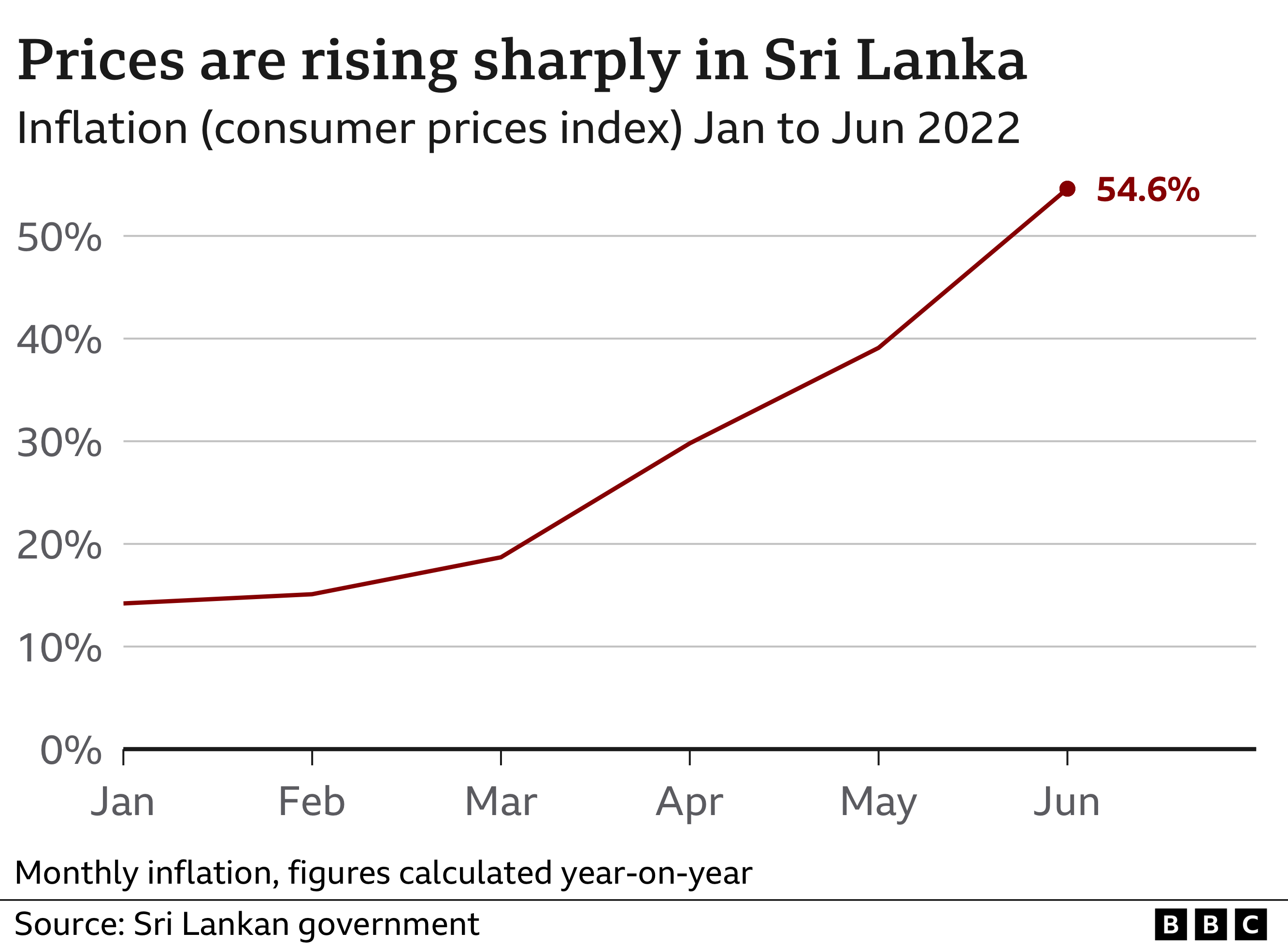

Expansion is running at over half.

The nation needs more fuel for fundamental administrations like transports, trains and clinical vehicles, and authorities say it needs more unfamiliar cash to import more.

This absence of fuel has made petroleum and diesel costs rise emphatically.

In late June, the public authority prohibited the offer of petroleum and diesel for unnecessary vehicles for a considerable length of time. Deals of fuel remain seriously confined.

Schools have shut, and individuals have been approached to telecommute to assist with moderating supplies.

What happens when a nation hits a dead end financially?

Sri Lanka can't buy the merchandise it needs from abroad.

What's more, in May it neglected to make an interest installment on its unfamiliar obligation without precedent for its set of experiences.

Auto carts line to bring fuel from a corner store in the midst of a fuel lack in Colombo, Sri Lanka, 17 June 2022.

Long lines for fuel - like this one in Colombo - have made ordinary life unthinkable

Inability to pay obligation premium can harm a country's standing with financial backers, making it harder for it to get the cash it needs on global business sectors.

This can additionally hurt trust in its cash and economy.

What's the arrangement to handle the emergency?

Prior to venturing down he made Prime Minister Ranil Wickremesinghe acting president.

Mr Wickremesinghe proclaimed a highly sensitive situation the nation over and forced a time limitation in the western territory while he attempts to balance out the circumstance.

Yet, on Wednesday, many dissenters raged his office, in the midst of requires his acquiescence.

The president's takeoff compromises a potential power vacuum in Sri Lanka.

It needs a working government to handle the monetary emergency.

The nation owes more than $51bn (£39bn) to unfamiliar banks, including $6.5bn to China, which has started conversations about rebuilding its credits.

The G7 gathering of nations - Canada, France, Germany, Italy, Japan, UK and the US - had said it upholds Sri Lanka's endeavors to pay off its obligation reimbursements.

The World Bank has consented to loan Sri Lanka $600m, and India has presented somewhere around $1.9bn.

The International Monetary Fund (IMF) is examining a potential $3bn (£2.5bn) credit.

In any case, it would require a steady government that could raise loan costs and expenses to assist with subsidizing the arrangement, so any bailout might be deferred until another organization is set up.

A lady in a dissent against food cost climbs bangs dishes together.

Banging dishes together to dissent at the food cost climbs.

Mr Wickremesinghe had previously said the public authority would print cash to pay workers' pay rates, yet cautioned this would probably help expansion and lead to additional cost climbs.

He additionally said state-possessed Sri Lankan Airlines could be privatized.

The nation has requested that Russia and Qatar supply it with oil at low costs to assist with decreasing the expense of petroleum.

What prompted the financial emergency?

The public authority accused the Covid pandemic, which gravely impacted Sri Lanka's traveler exchange - one of its greatest unfamiliar money workers.

It likewise says travelers were terrified off by a progression of destructive bomb assaults in 2019.

Notwithstanding, numerous specialists fault President Rajapaksa's poor monetary bungle.

Sri Lanka's President Gotabaya Rajapaksa (C) addresses the country alongside Army Commander Shavendra Silva (L), Navy Chief Nishantha Ulugetenne (2L) and Airforce Chief Sudarshana Pathirana (R) during the Sri Lanka's 73rd Independence Day festivities in Colombo on February 4, 2021

Mr Rajapaksa's flight closes a family tradition that has overwhelmed Sri Lanka's legislative issues for the beyond twenty years

Toward the finish of its considerate conflict in 2009, Sri Lanka decided to zero in on giving merchandise to its homegrown market, rather than attempting to support unfamiliar exchange.

This implied its pay from commodities to different nations stayed low, while the bill for imports continued to develop.

Sri Lanka presently imports $3bn (£2.3bn) more than it trades consistently, and for that reason it has run out of unfamiliar cash.

Toward the finish of 2019, Sri Lanka had $7.6bn (£5.8bn) in unfamiliar money saves, which have dropped to around $250m (£210m).

Mr Rajapaksa was likewise scrutinized for huge tax reductions he presented in 2019, which lost the public authority pay of more than $1.4bn (£1.13bn) a year.

At the point when Sri Lanka's unfamiliar money deficiencies turned into a difficult issue in mid 2021, the public authority attempted to restrict them by forbidding imports of substance compost.

It advised ranchers to utilize privately obtained natural manures all things considered.

This prompted boundless yield disappointment. Sri Lanka needed to enhance its food stocks from abroad, which made its unfamiliar cash lack far more atrocious.

0 Comments